Purpose · Vision · Values

Initial Client Conversation

The Client Journey

Initial Advisor Conversation

The Advisor Journey

THE 9 FREEDOM STEPS®

A clear, simple path to build stability, eliminate debt, grow wealth, and create the life you were meant to live!

Step 1: Get Aligned to Your Freedom Number (FIN)

Discover the exact amount of money your family needs to live in freedom and align your current investments to hit the target! This gives you clarity, direction, and a target you can actually hit.

Step 2: Activate Free Government Benefits (RESP & RDSP)

Make sure you’re capturing every dollar of free government matching available. This step gives your family a head start using benefits most Canadians miss.

Step 3: Implement Insurance & Protection Strategy

Protect your income, your family, and your future from life’s biggest risks. The right strategy ensures one crisis doesn’t wipe out everything you’ve built.

Step 4: Build a $1,500 Emergency Fund & Zero-Based Budget

Establish immediate financial stability with a starter emergency fund and a simple, freedom-focused budget. This reduces stress and creates instant breathing room.

Step 5: Implement Debt Elimination Strategy

Attack high-interest debt with a proven, structured plan. This step frees up your income and helps you redirect money toward your future instead of interest.

Step 6: Maximize Wealth-Building Strategy

Invest with purpose using simple, transparent strategies. This aligns your money with your long-term goals so your wealth grows consistently and tax efficiently.

Step 7: Invest in Your Children’s Future

Build a flexible, transparent plan that supports your children’s education or future goals. This step ensures your investments work for your family, not for restrictive programs.

Step 8: Strategically Become Mortgage Free

Accelerate your path to ownership with smart, strategic decisions. Small adjustments can save you years and tens of thousands in interest.

Step 9: Experience Financial Freedom & Live Generously

Reach the place where your money supports the life you want — giving you freedom to enjoy, grow, and bless others. This is the lifestyle you’ve been building toward.

Get Aligned To Your Freedom Number

Your north star – the wealth you need to cover your lifestyle indefinitely.

Assessment of current assets alignment to Freedom Number (FIN)

Client Presentation

Activate Free Government Benefits

(RESPs & RDSPs)

Open RESP – Capture the Canada Learning Bond (CLB): a one-time $500 amount + $100 per year

Open RDSP – Capture the Canada Disability Savings Bond (CDSB): $1,000 per year, retroactive to the year of DTC approval

Client Presentation

Advisor Resources

Implement Insurance & Protection Strategy

Protect your income, your family, and your future from life’s biggest risks. The right strategy ensures one crisis doesn’t wipe out everything you’ve built.

Income Protection (HIGHEST PRIORITY)

Other Insurance (H&D, CI, Travel, etc)

Protection Referral Programs

LIFE INSURANCE

LIFE INSURANCE FOUNDATION

COMMON LIFE INSURANCE SCENARIOS

SPECIAL HARD TO INSURE CIRCUMSTANCES

QUICK LIFE INSURNACE TUTORIALS

HOW TO ACCESS QUICK QUOTE?

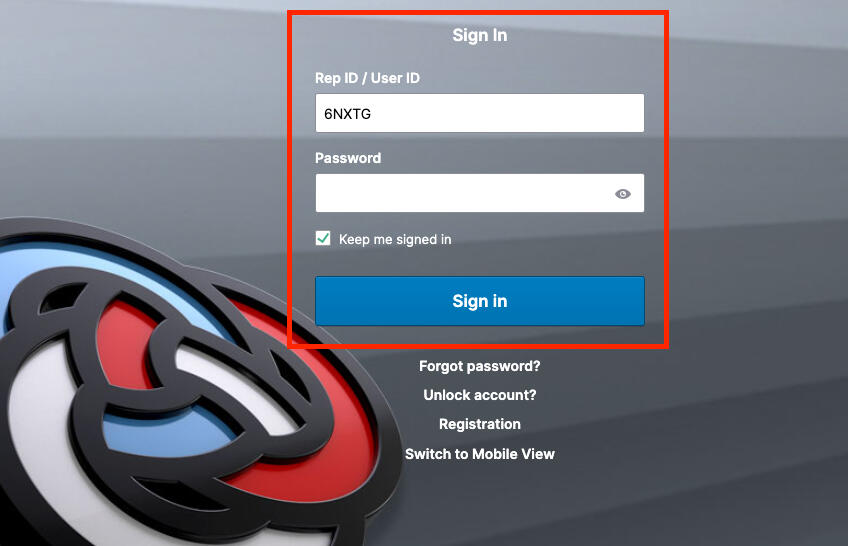

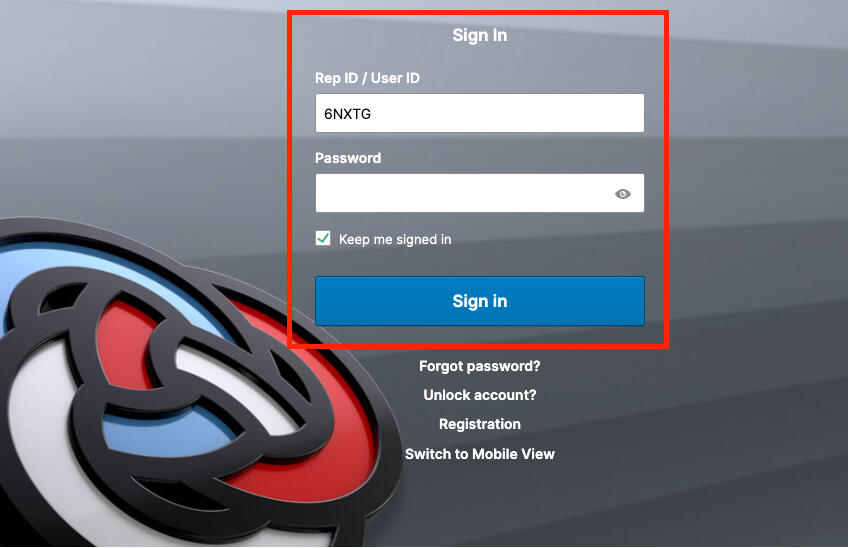

1. Log into Primerica Online (POL)

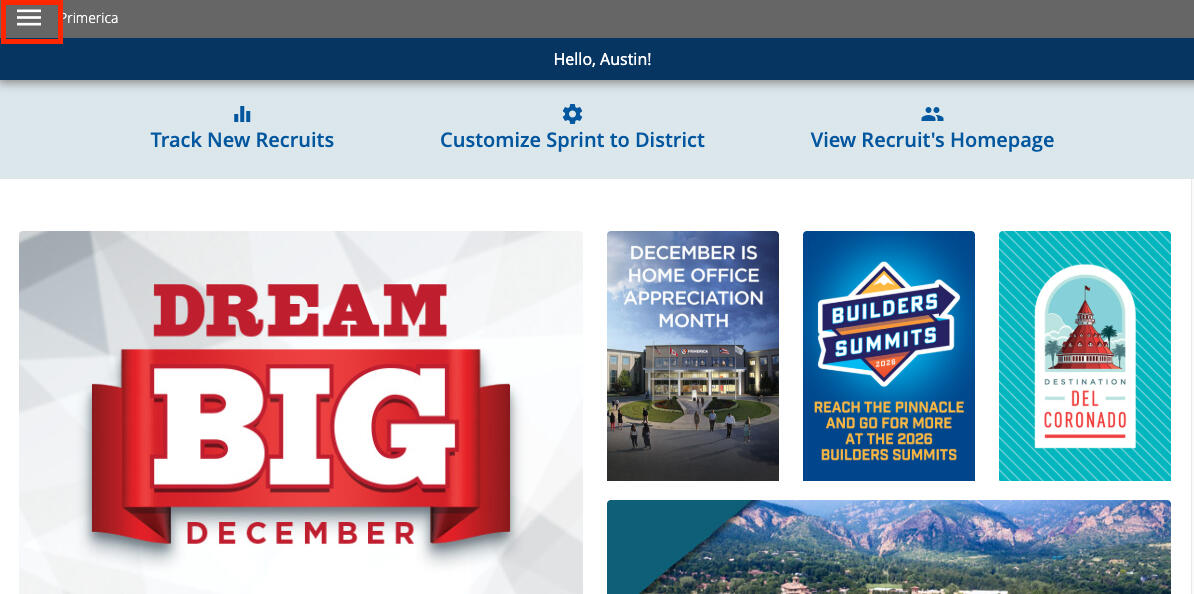

2. In the top left corner, hit the 3 lines for menu!

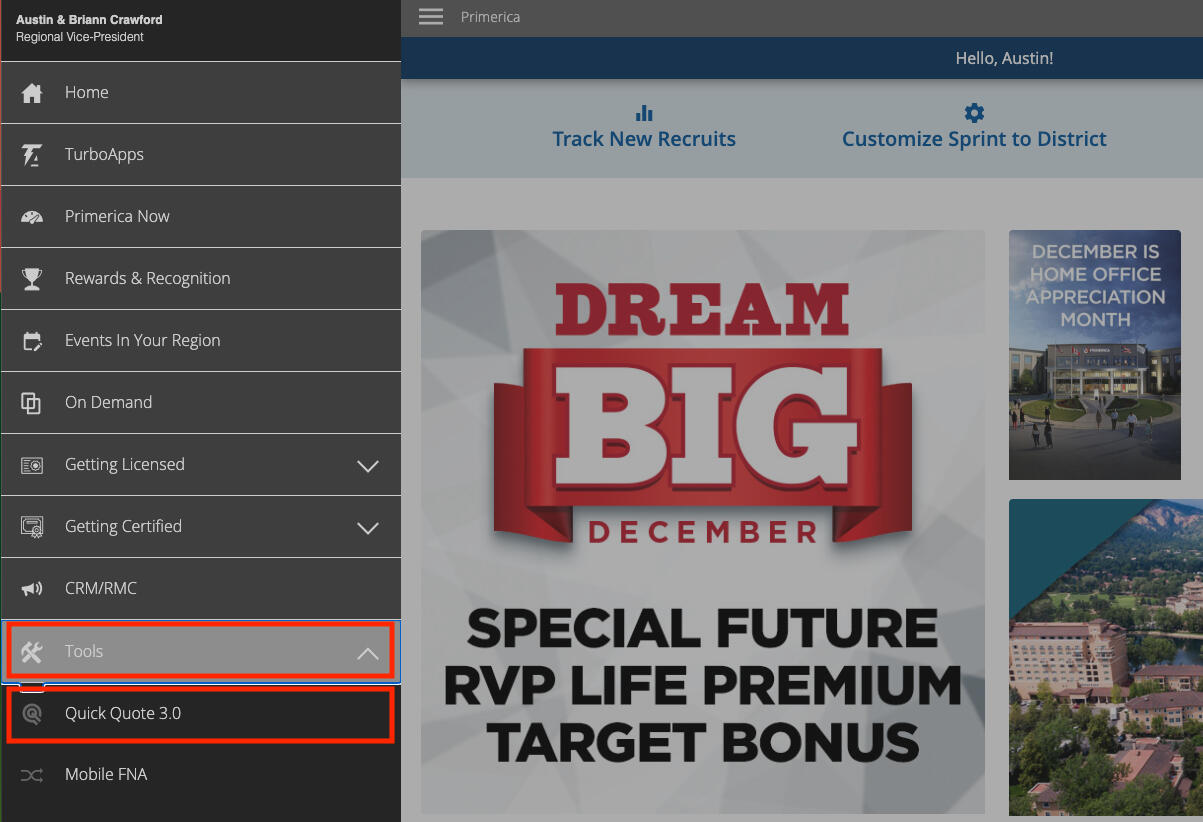

3. In the menu, find "Tools" > Quick Quote 3.0

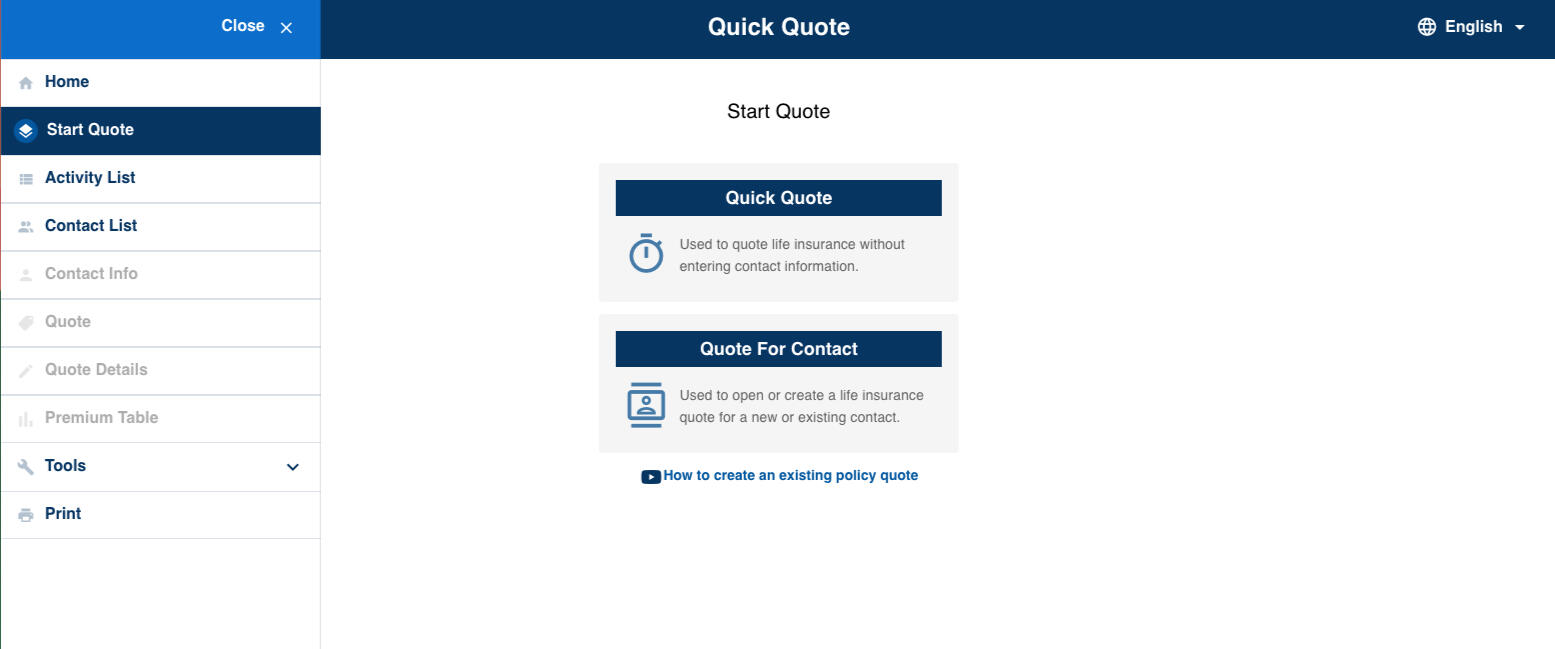

4. Begin using Quick Quote 3.0

5. Generic Quick Quote Video Tutorial

6. Quick Quote for a Contact Video Tutorial

HOW TO COMPLETE LIFE INSURANCE APPLICATION?

1. Life 4.0: Before You Begin Video Tutorial

2. Life 4.0: Getting Started Video

3. Life 4.0: Personal Info (CAN) Video Tutorial

4. Life 4.0: Children, Policy Owner & Beneficiaries Video Tutorial

5. Life 4.0: Existing Insurance (CAN) Video Tutorial

6. Life 4.0: Medical Questions Video

7. Life 4.0: Add Coverage Video Tutorial

8. Life 4.0: Health & Coverage DocuSign Signatures Video Tutorial

8. Life 4.0: Payment Video Tutorial

9. Life 4.0: Review & Pay DocuSign Signatures Video Tutorial

EDGE BENEFITS

HOW TO ACCESS EXPRESS QUOTE?

1. Log into Primerica Online (POL)

2. Products > Health Benefits (CAN)

3. Click "the EDGE" logo!

*IF THIS IS YOUR FIRST TIME YOU WILL BE PROMPTED TO REGISTER AND COMPLETE A CERTIFICATION PROCESS

4. Find Sales Resources > Express Quote > Application

5. Start Quotes & Application

EDGE PRODUCT TRAINING

SUREX INSURANCE

YOUR SUREX LINK

EMAIL YOUR REFERRAL PROGRAM LINKS

Do NOT email without testing ALL your referral links!

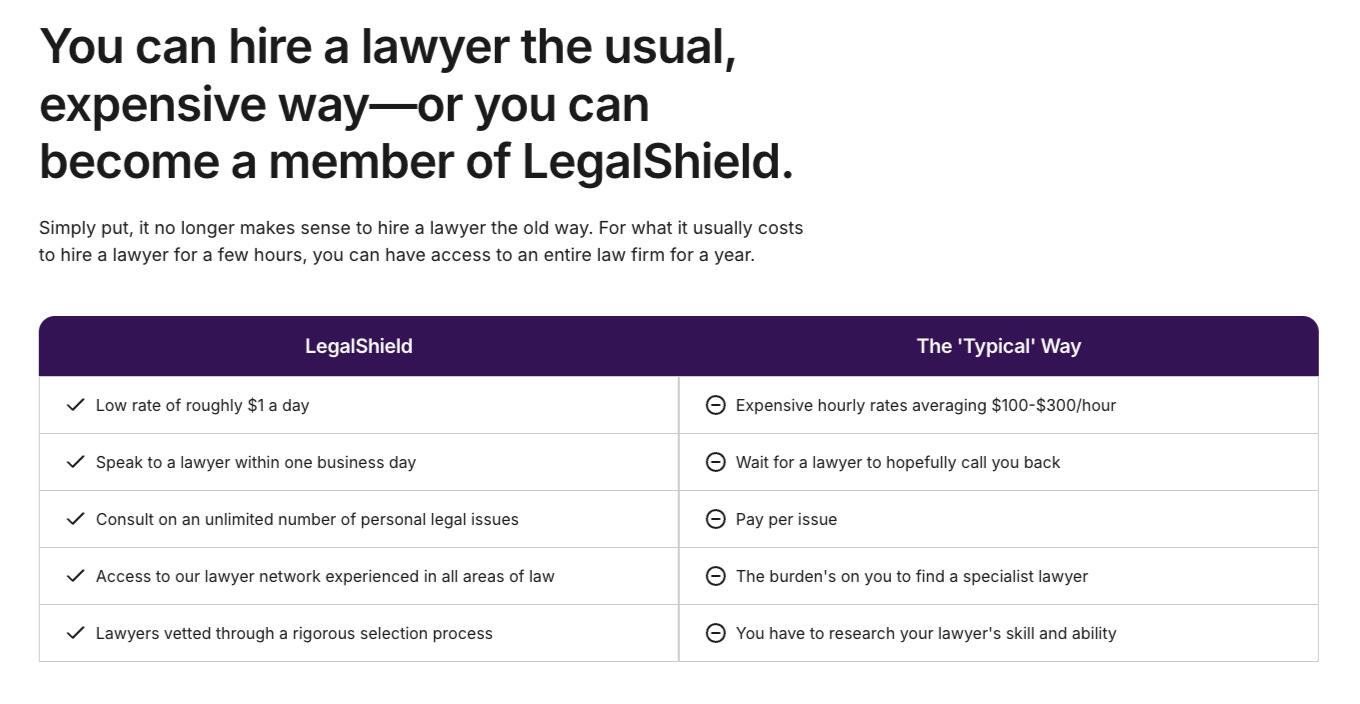

LEGALSHIELD

YOUR LEGALSHIELD LINK

EMAIL YOUR REFERRAL PROGRAM LINKS

Do NOT email without testing ALL your referral links!

Build $1,500 Emergency Fund

& Zero-Based Budget

Save a quick $1,500 buffer to cover small emergencies and prevent new debt.

Maximum of 3 months expenses for fully funded emergency fund (Employment Insurance lowers risk).

Create a zero-based budget: assign every dollar a purpose — spending, saving, or giving.

Implement Debt Elimination Strategy

Eliminate all debt outside of the mortgage - credit cards, lines of credit, car loans.

Client Presentation

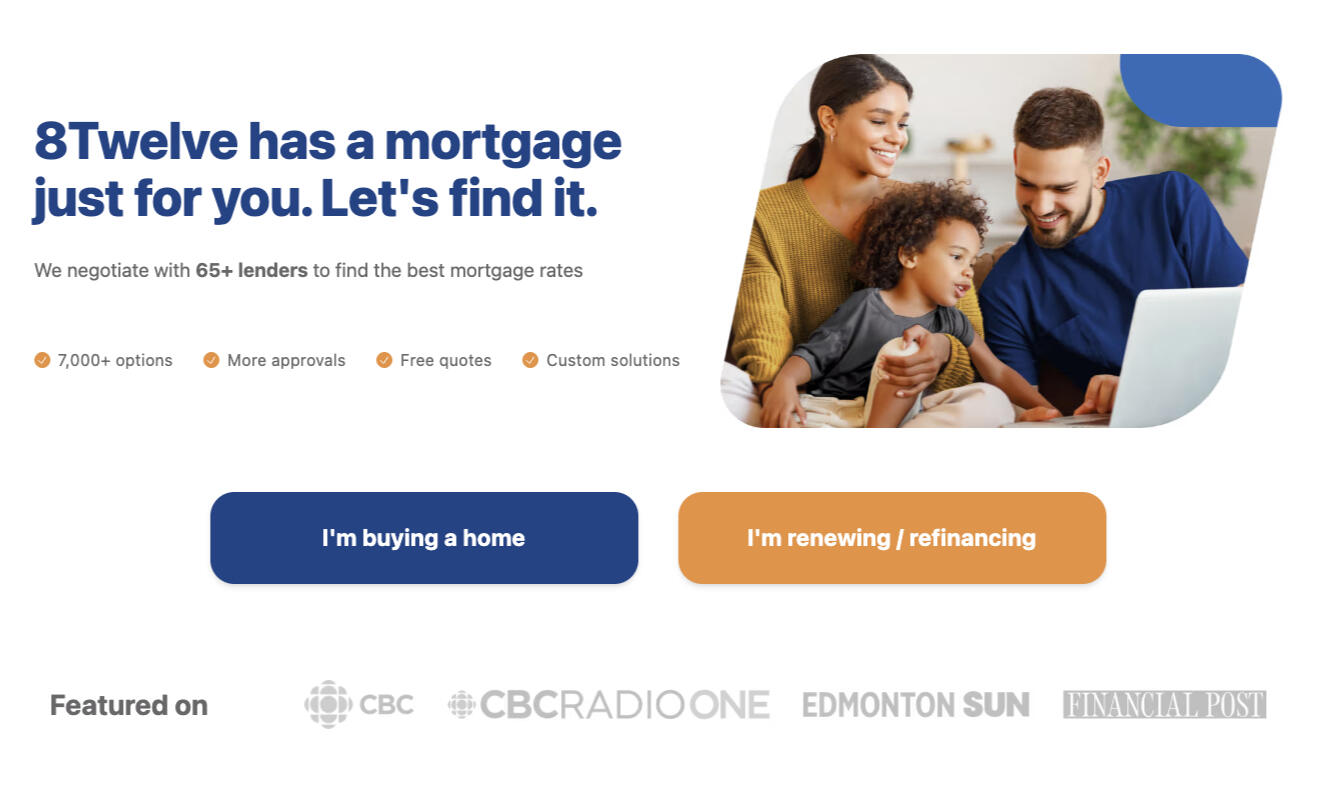

8TWELVE MORTGAGE

YOUR 8TWELVE MORTGAGE LINK

EMAIL YOUR REFERRAL PROGRAM LINKS

Do NOT email without testing ALL your referral links!

Maximize Wealth-Building Strategy

Get on track to reach your Freedom Number (FIN) by contributing the right amounts.

Grow your wealth tax-efficiently by using the right registered accounts.

Buy a house

Client Presentation

Advisor Resources

Invest in Your Children's Future

$2,500 per child per year maximizes government grants

Up to two years of grants can be earned in one calendar year

Strategically Become Mortgage Free

Consider using accelerated biweekly payments, lump sums, and prepayments to pay off your home faster and save thousands in interest.

Experience Financial Freedom

& Live Generously

Celebrate reaching financial freedom — travel, lifestyle upgrades, and peace of mind.

Use your resources to give back: church, charities, community, and family.

Shift from success → significance.

True legacy = wealth + wisdom + values passed on.